Growth stocks have been clobbered this year amid inflationary pressures, high interest rates, and fears of a looming recession. Many growth names saw an accelerated rise in their businesses due to pandemic-induced demand and government stimulus. But, with the reopening of economy and a challenging macro environment, growth rates have normalized.

While the focus now has shifted to value bets, there are some investors who are looking beyond near-term disruptions and are keen to use the significant pullback in growth stocks as an attractive opportunity to build a position.

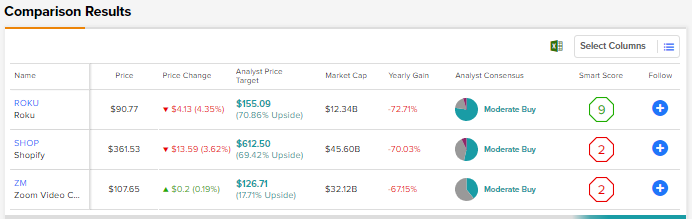

Using the TipRanks Stock Comparison tool, we’ll place Roku, Shopify, and Zoom against each other and pick the growth stock with better potential, at the current levels.

Roku (NASDAQ: ROKU)

Roku generates a major portion (83% in 2021) of its revenue through digital advertising sales, content distribution services, and other services on its platform. The remaining revenue is derived from the sale of its streaming players and audio products. Roku had 61.3 million active accounts as at the end of Q1’22.

Roku’s growth rates have slowed down over the recent quarters due to the fading of pandemic-led tailwinds. Q1’22 revenue grew 28% to $734 million, exceeding analysts’ estimates. However, Roku slipped to a loss per share of $0.19 from EPS of $0.54 in the prior-year quarter.

Also, the Q2’22 revenue growth outlook of nearly 25% reflects continued moderation as macro headwinds and supply chain bottlenecks are expected to impact TV unit sales, and thus new accounts growth. Roku expects full-year revenue growth of 35%.

Recently, Citi analyst Jason Bazinet lowered his price target on Roku stock to $175 from $225 due to valuation concerns amid slowing growth among streaming services like Netflix (NFLX). That said, the analyst remains confident that Roku is well-positioned to gain from the “secular shift of ad dollars moving from linear to connected TVs.”

All in all, the Street is cautiously optimistic with a Moderate Buy consensus rating based on 17 Buys, four Holds, and one Sell. At $155.09, the average Roku price target implies 70.86% upside potential from current levels.

Shopify (NYSE: SHOP)

Business on e-commerce platform Shopify has cooled down since the reopening of economy with shoppers back at physical retail stores.

Amid tough comparisons and a difficult macro environment, Shopify’s Q1’22 results lagged analysts’ expectations. Revenue grew 22% to $1.2 billion, while adjusted EPS fell drastically to $0.20 from $2.01 in the prior-year quarter due to higher expenses and growth investments.

Looking ahead, Shopify is acquiring Deliverr, a fulfillment technology provider, for $2.1 billion, as part of its efforts to bolster its logistics and fulfillment capabilities.

Following Q1 results, Robert W. Baird analyst Colin Sebastian slashed his price target for Shopify stock to $630 from $1000 but reiterated a Buy rating. Sebastian didn’t find the company’s dismal results surprising given the weakening e-commerce trends noted since mid-February.While Sebastian continues to see very compelling long-term growth prospects for Shopify across e-commerce, payments, software, and fulfillment, he remains cautious over the near-term due to the challenging macro backdrop and shifting consumer spending patterns.

All in all, 15 Buys, 11 Holds and two sells amount to a Moderate Buy consensus rating. The average Shopify price target of $612.50 implies 69.42% upside potential from current levels.

Zoom Video Communications (NASDAQ: ZM)

Zoom’s growth spiked during the onset of COVID-19 as its video conferencing platform connected millions of users who were forced to adopt to remote working and online education.

While Zoom’s revenue growth has decelerated from COVID-peaks, it recently reported upbeat Q1 FY23 (ended April 30, 2022) earnings and better-than-expected profitability outlook. Q1 revenue grew 12% to $1.07 billion. Adjusted EPS declined 22% to $1.03, but smashed analysts’ estimates of $0.87.

In a note to investors following the print, William Blair analyst Matt Stotler pointed to the robust demand for Zoom Rooms and Zoom Phone, which exceeded 3 million seats in Q1, and the encouraging response to newer solutions, like Zoom Contact Center, Zoom Whiteboard and Zoom IQ.

Stotler acknowledges these favorable developments and continues to “believe that there is potential for Zoom to generate positive business momentum into the end of the year as the company annualizes tough comps and moves out of the post-COVID period of high low-end churn.”

Stotler reiterated a Buy rating as he believes that Zoom’s positioning in a huge and underpenetrated market can fuel sustainable growth over the longer-term in a normalized environment.

Further, Daiwa analyst Stephen Bersey double upgraded Zoom to Buy from Sell, and raised the price target to $121 from $107 as he feels that the recent sell-off offers an attractive entry point. Bersey likes Zoom’s core business and opines that growth expectations “seem more realistic” now.

Overall, Zoom scores a Moderate Buy consensus rating that breaks down into eight Buys and 13 Holds. The average Zoom price target of $125.84 implies 16.90% upside potential in the 12 months ahead.

Conclusion

Shares of Roku, Shopify, and Zoom are down 60%, 74%, and 42% respectively, year-to-date. Wall Street is cautiously optimistic about these stocks due to the prevailing macro headwinds. Considering the proportion of analysts with a bullish stance and a higher upside potential, Roku stock seems to be a better pick, currently.

On TipRanks’ Smart Score system, Roku earns a nine of out 10 score, indicating that the stock is likely to outperform the market.

Read full Disclosure

This article was originally published on this site